In the ever-evolving landscape of the manufacturing industry, the demand for advanced steel fabrication machinery has become paramount for maximizing efficiency and productivity. Renowned industry expert, Dr. Emily Carter, a leading figure in metalworking technology, once noted, "The integration of innovative steel fabrication machinery is not just a trend; it’s an essential step towards achieving operational excellence in metalworking solutions." Her insight echoes the pressing need for manufacturers to adopt cutting-edge equipment that enhances precision and streamlines workflows.

As we look ahead to 2025, the landscape of steel fabrication machinery is poised for significant transformation, driven by technological advancements and the increasing need for sustainable practices. In this article, we delve into the top five steel fabrication machines anticipated to revolutionize metalworking processes. From laser cutting technology to CNC machining, each piece of machinery offers unique capabilities that cater to diverse manufacturing requirements, enabling businesses to stay competitive in a rapidly changing market. Emphasizing the importance of adopting the latest machinery will empower industry players to capitalize on new opportunities and achieve greater operational efficiency in their production lines.

In 2025, advancements in steel fabrication machinery are poised to significantly enhance efficiency in the metalworking industry, driven by cutting-edge technologies such as automation, AI integration, and advanced material processing. According to a report by MarketsandMarkets, the global market for metal fabrication equipment is forecasted to reach $106 billion by 2027, with automation technologies contributing to a projected growth of 7.5% annually. This transformation not only reduces operational costs but also enhances precision, leading to superior product quality.

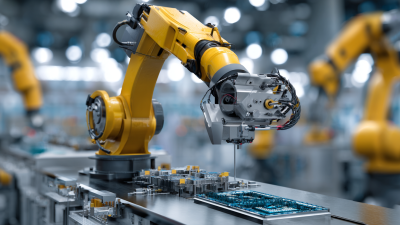

One of the most notable advancements includes the integration of AI and machine learning algorithms in CNC machining centers and robotic welding systems. These technologies enable real-time monitoring and predictive maintenance, which can minimize downtime by up to 25%, as reported by the International Federation of Robotics. Additionally, 3D printing technology is becoming increasingly prevalent, allowing for complex component designs that were previously impossible, thereby streamlining production processes and reducing waste. As the steel fabrication industry embraces these innovations, stakeholders are set to gain a competitive edge while meeting the growing demand for high-quality metal products.

When selecting steel fabrication equipment, three critical factors should be considered: capacity, precision, and automation. Capacity is fundamental; it determines the volume of material that can be processed at any given time. As industries demand increased production rates, machinery that can handle larger workloads without compromising efficiency becomes essential. High-capacity equipment ensures that businesses can meet growing consumer demands and maximize output.

Precision is equally crucial, especially in sectors like aerospace and automotive, where the tolerance levels required for components are stringent. Investing in machinery that offers high accuracy can significantly reduce waste and rework costs, ultimately enhancing profitability. Automation plays a vital role as well, with advancements in technology facilitating the integration of smart systems into fabrication processes. Automated solutions not only streamline operations but also improve safety and consistency in production. As highlighted by market analysis, the growth trajectory of the industrial robotics and metal fabrication sectors indicates a clear trend towards equipment that embodies these essential qualities to maintain competitiveness in a rapidly evolving marketplace.

As we look at the emerging trends in steel fabrication influenced by Industry 4.0, the global CNC machine market stands out with a projected growth from $101.22 billion in 2025 to $195.59 billion by 2032, reflecting a robust CAGR of 9.9%. This impressive expansion indicates a shift towards more automated and efficient metalworking processes, driven largely by advancements in technology and the increasing demand for precision fabrication. Similarly, the GCC structural steel fabrication market is on an upward trajectory, propelled by mega-infrastructure projects and urbanization particularly in Saudi Arabia, UAE, and Qatar.

In addition to CNC machines, the global metal fabrication equipment market is expected to rise from $64.64 billion in 2025 to $82.78 billion by 2032, showing a growth rate of 3.6%. This growth is indicative of a broader trend toward modernization within the industry, where traditional methods are being enhanced with advanced technologies. As enterprises adopt innovative solutions that prioritize efficiency and sustainability, the metalworking landscape will continue to evolve, highlighting the importance of staying abreast of these market dynamics to remain competitive in the upcoming years.

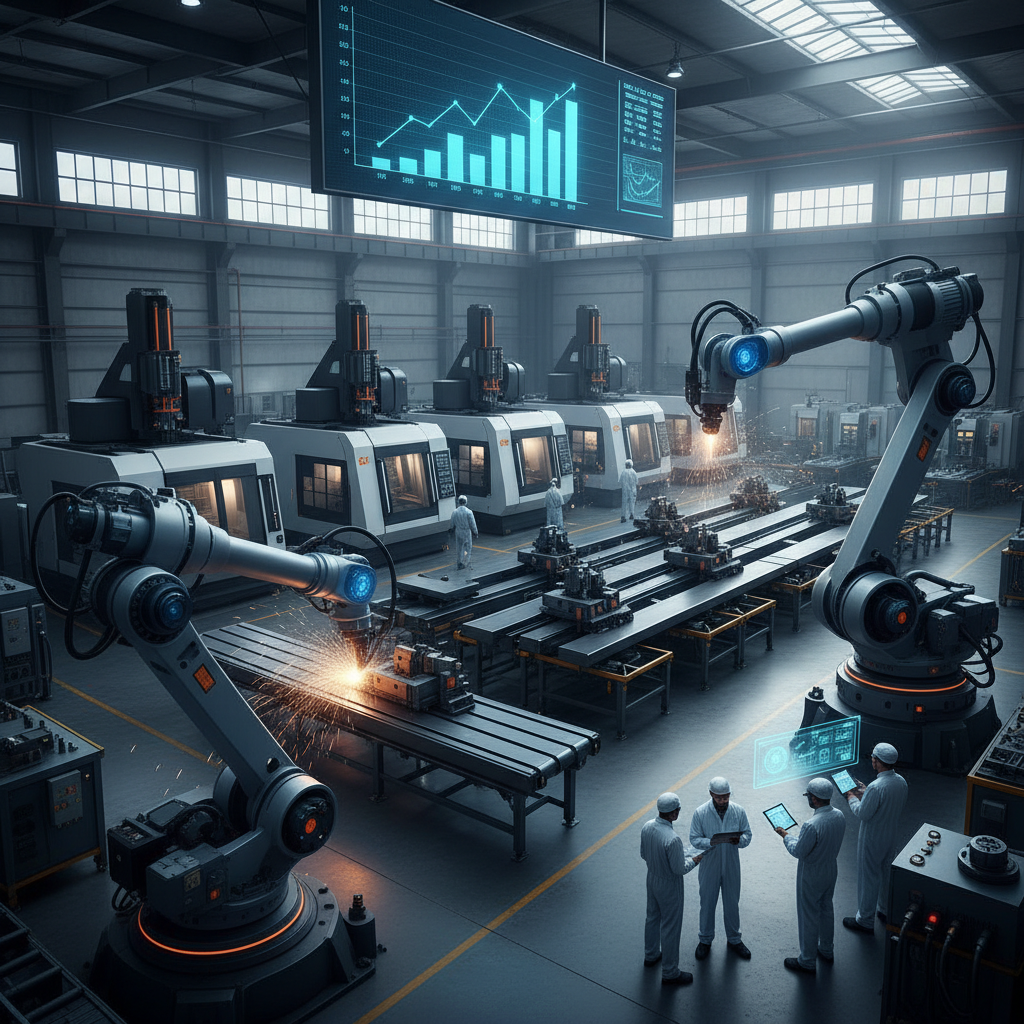

In today's competitive market, the cost efficiency and return on investment (ROI) of steel fabrication machinery are crucial factors for manufacturers aiming to enhance productivity and profitability. According to a report by MarketsandMarkets, the global steel fabrication market is expected to grow from $16.29 billion in 2020 to $23.43 billion by 2025, emphasizing the demand for advanced machinery that supports efficient metalworking solutions. Investing in top-tier steel fabrication machines can significantly reduce labor costs and processing time, leading to improved profit margins.

A comparative analysis indicates that advanced CNC (Computer Numerical Control) machines can yield an ROI of up to 25% within the first year of operation. These machines not only offer precision and efficiency but also automate labor-intensive processes that traditionally relied on manual methods. Moreover, research from IBISWorld highlights that businesses that adopt automated fabrication technologies benefit from a 15-30% reduction in material wastage, subsequently lowering production costs. Thus, choosing the right machinery not only accelerates production but also plays a vital role in maximizing the overall financial performance of steel fabrication enterprises.

Sustainability in steel fabrication is increasingly becoming a central focus for manufacturers striving to reduce their environmental footprint. Many leading companies are investing heavily in eco-friendly technologies and processes to enhance their metalworking solutions. For instance, the development of state-of-the-art manufacturing facilities emphasizes energy efficiency and reduced waste, showcasing how sustainability can drive growth while minimizing ecological impact. Innovations such as water-based cutting fluids and biodegradable lubricants highlight the industry's shift towards greener alternatives that maintain performance standards.

Furthermore, firms are actively promoting eco-products in their portfolios, reflecting a growing commitment to sustainability. The introduction of specialty chemicals designed for corrosion protection and optimized equipment efficiency contributes to a more sustainable manufacturing landscape. As machine tool manufacturers embrace sustainability, they not only address regulatory pressures but also respond to consumer demands for responsible production practices. The integration of automation and AI in manufacturing processes further enhances both operational efficiency and sustainability, paving the way for a more eco-conscious metalworking industry.