As we approach 2025, the landscape of state contract manufacturing is set to undergo significant transformations. The sector has already demonstrated resilience, adapting to emerging technologies and shifting consumer demands. According to a recent report by IBISWorld, the state contract manufacturing industry is projected to grow at an annual rate of 4.2% over the next five years, reflecting a strong trend towards outsourcing as companies seek to optimize production costs and enhance efficiency.

Industry expert Dr. Emily Chen, a leading voice in manufacturing strategy, emphasizes the strategic importance of this shift: "In an era where agility and speed-to-market can define success, state contract manufacturing offers enterprises the flexibility they need to thrive." This perspective highlights the increasing reliance on external partners to navigate complex supply chains while fostering innovation and maintaining competitive advantage.

As we delve into the top trends shaping state contract manufacturing for 2025, it is crucial to understand the interplay of technological advancements, regulatory changes, and market dynamics that will influence decision-making for manufacturers and their partners.

As we approach 2025, state contract manufacturing is poised for transformative changes driven by emerging technologies. Key trends indicate that automation and artificial intelligence (AI) will play a pivotal role in enhancing efficiency and productivity across the manufacturing sector. According to a recent industry report, approximately 70% of manufacturers plan to adopt advanced robotics systems by 2025, aiming to reduce operational costs and minimize human error. This technological shift not only streamlines production processes but also enables manufacturers to respond swiftly to market demands.

Moreover, the integration of IoT (Internet of Things) devices is revolutionizing supply chain management. It is predicted that 80% of manufacturers will use IoT solutions to gain real-time visibility into their operations by 2025, thus facilitating better decision-making and resource allocation. These advancements will allow manufacturers to predict maintenance needs, optimize inventory levels, and improve overall product quality.

Tips: As you navigate these changes, consider investing in staff training to ensure that your team is equipped to leverage new technologies effectively. Additionally, staying updated on industry trends and technologies through webinars and conferences will provide your business with a competitive edge. Embracing these innovations will not only enhance operational efficiency but also open new avenues for growth in the ever-evolving landscape of state contract manufacturing.

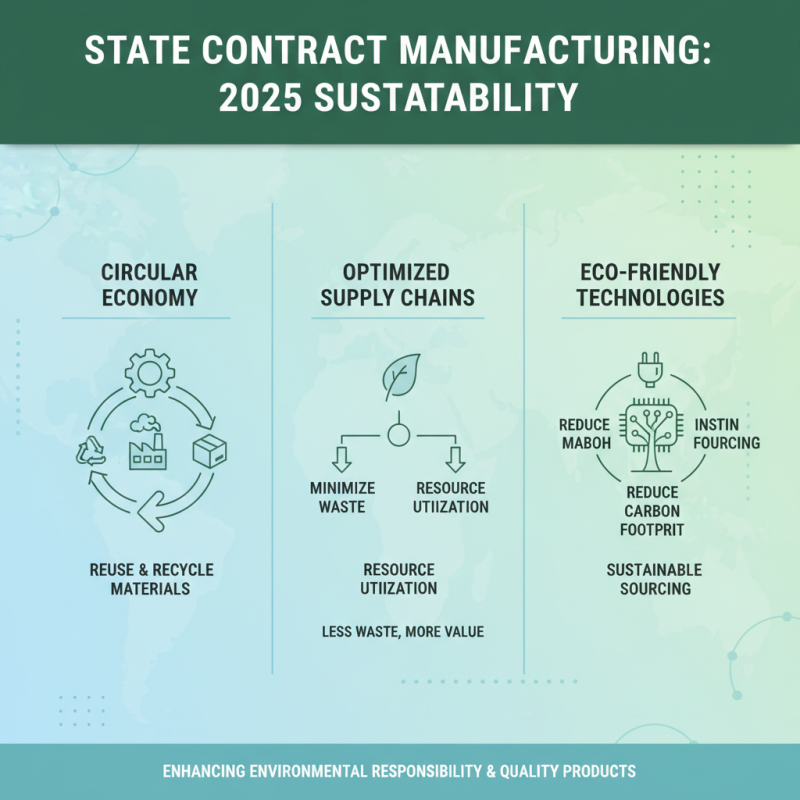

As we look towards 2025, sustainability practices in state contract manufacturing are set to become a paramount consideration for companies aiming to enhance their environmental responsibility. Manufacturers are increasingly adopting circular economy principles, emphasizing the reuse and recycling of materials throughout the production process. This trend encourages businesses to rethink their supply chains, employing strategies that minimize waste and optimize resource utilization. By implementing sustainable sourcing practices and eco-friendly technologies, manufacturers can significantly reduce their carbon footprint while still meeting the growing demand for quality products.

Additionally, the integration of innovative green technologies will play a crucial role in the evolution of state contract manufacturing. Automation and smart manufacturing systems offer opportunities to streamline production processes, leading to lower energy consumption and reduced emissions. Collaboration between manufacturers and suppliers is vital to developing sustainable practices that align with both economic and ecological goals. With stakeholders prioritizing sustainability, companies that embrace these practices are likely to gain a competitive edge in an increasingly environmentally-conscious marketplace, positioning themselves as leaders in the transition toward a greener future in manufacturing.

The landscape of state contract manufacturing is set to undergo significant changes by 2025, primarily driven by evolving regulatory frameworks. As outlined in a report by the Association for Manufacturing Excellence (AME), over 60% of manufacturers are anticipating stricter compliance measures, which will necessitate a reevaluation of current practices. The U.S. regulatory environment, responding to rapid technological advancements and increased scrutiny on manufacturing safety, is pushing manufacturers to invest more in compliance-related technologies and processes. This transition is expected to lead to an increase in operational costs, with estimates projecting a rise of 15-20% in compliance expenditures by 2025.

Furthermore, regulatory changes will also focus on sustainability practices within state contract manufacturing. According to a recent study by the National Association of Manufacturers (NAM), nearly 75% of companies are preparing for new environmental regulations that require them to implement greener manufacturing practices. This shift isn't purely a response to governmental pressure; consumer demand for more sustainable products is driving this change. By 2025, it is anticipated that companies implementing sustainable manufacturing processes will see a competitive advantage in the marketplace, with the potential for a 25% increase in consumer preference for eco-conscious products. Companies that prioritize regulatory compliance and sustainability will not only meet legal requirements but also align with market trends that favor responsible manufacturing practices.

This chart displays the projected growth in various sectors of state contract manufacturing by 2025, reflecting the impact of regulatory changes.

As we look forward to 2025, the landscape of state contract manufacturing is set to be significantly transformed by the integration of automation and artificial intelligence (AI). These technologies are not only streamlining production processes but also enhancing overall efficiency across various manufacturing sectors. Automation reduces the need for manual intervention, which minimizes human error and speeds up production times. AI algorithms can analyze vast amounts of data in real-time, enabling companies to optimize their operations, predict maintenance needs, and adapt to changing market demands swiftly.

Tips for implementing automation and AI in manufacturing include starting small. Begin with pilot projects that focus on specific processes where inefficiencies are prevalent. This will allow for careful monitoring and adjustment without overwhelming your current system. Additionally, investing in staff training is crucial; employees need to understand the new technologies to effectively collaborate with automated systems.

Another important tip is to foster a culture of continuous improvement. Encourage teams to share insights and feedback on the automation and AI processes. This will not only enhance systems but also ensure that employees feel engaged and valued in the transition. By embracing these technologies and focusing on employee involvement, manufacturers can position themselves competitively for the future.

| Trend | Description | Impact on Efficiency | Projected Adoption Rate (%) |

|---|---|---|---|

| Automation | Increase in robotic automation for repetitive tasks. | Significantly reduces labor costs and errors. | 80% |

| AI Integration | Use of AI for predictive maintenance and production planning. | Enhances decision-making and minimizes downtime. | 75% |

| Digital Twin Technology | Creation of digital replicas of manufacturing processes. | Improves process optimization and real-time monitoring. | 65% |

| Smart Factory Initiatives | Implementation of connected devices and systems. | Enhances collaboration and productivity across the supply chain. | 70% |

| Sustainability Practices | Adoption of green technologies and waste reduction strategies. | Boosts efficiency while reducing environmental impact. | 60% |

As we look toward 2025, several key industries are poised to drive growth in state contract manufacturing. The rapid advancements in technology, particularly in areas such as automation and additive manufacturing, are reshaping production capabilities. Industries such as aerospace and defense are increasingly relying on contract manufacturers to meet the demand for specialized components, driven by government contracts and increased defense budgets. This shift is encouraging firms to invest in sophisticated manufacturing processes that cater to high precision and quality requirements.

Moreover, the healthcare sector is emerging as a significant contributor to the state's contract manufacturing landscape. The rising demand for medical devices, pharmaceuticals, and personalized medicine, fueled by an aging population and a focus on health innovation, has necessitated a more flexible supply chain. Manufacturers are adapting their operations to accommodate shorter lead times and customized production runs, ensuring that they can respond quickly to market needs while adhering to stringent regulatory standards. As these trends unfold, the collaboration between state manufacturers and industries will intensify, creating opportunities for growth and innovation.